New investment puts digital imaging companies in the frame

Two Scottish digital image archiving specialists have joined forces to disrupt the global film digitisation industry following further growth equity from the Scottish Investment Bank (SIB) - the investment arm of Scottish Enterprise - and investment syndicate Kelvin Capital.

As part of the growth strategy, Glasgow based iMetaFilm has merged with UK Archiving, bringing together operations, combined expertise and patented technology with the business set to take advantage of a growing international market. The business will be based in Hamilton, at UK Archiving’s current premises, providing a cost effective, single point of contact for the flourishing digital archiving industry.

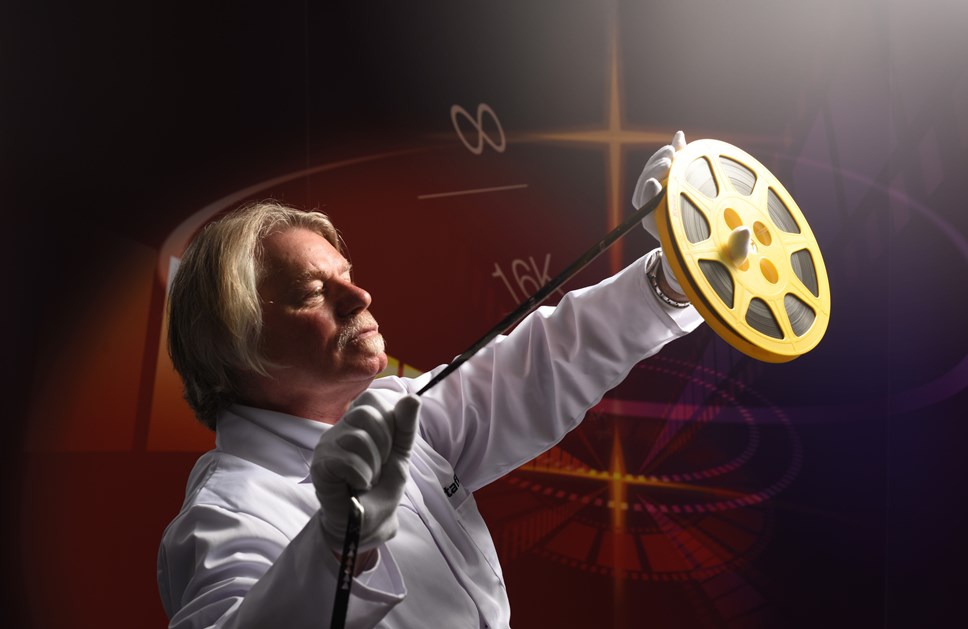

iMetaFilm has patent protected technology for the rapid digitisation of traditional moving film archives and has undertaken work for The Library of Congress in Washington DC, The Royal Society, Cambridge University, Edinburgh University, Glasgow University, Cuban National Film Archive, Hopscotch Films, Chivas Brothers and Diageo.

UK Archiving operates at the high end of the international digital archiving market with clients including the Senate Library, Tower of London, Science Museum and Wiener Library in London, the National Science and Media Museum in Bradford, Historic Environment Scotland in Edinburgh, National Library of Scotland and The Glasgow School of Art. Work for growing online genealogy websites Ancestry.com and findmypast.co.uk has also been successfully undertaken.

Led by the investment syndicate Kelvin Capital and the Scottish Investment Bank, the funding will allow the combined business to invest in new technical resources and staff to accelerate the commercialisation of iMetaFilm’s technology. The combined business currently employs 14 staff.

The GT4 Group, former owner of UK Archiving, has taken an equal shareholding in iMetaFilm which will see David Knox, previously managing director of UK Archiving, and three other members of The GT4 Group's executive team joining iMetafilm's board. David Knox will take on the role of managing director of iMetaFilm.

Kerry Sharp, director of the Scottish Investment Bank, said: “This deal represents an exciting step change for iMetaFilm after joining forces with UK Archiving. We look forward to continuing our support so they can achieve their ambition of becoming a global force in digital archiving.”

Angus Hay from Kelvin Capital said: “iMetaFilm’s technology is truly disruptive and a world first with a global patent portfolio. Combined with the outstanding client base and highly experienced management team of UK Archiving, we are looking at a true step change for this industry, providing a cost effective and significantly improved end product which requires zero preparation of the original film material, and that is a real game changer for the market.”

Michael Howell, founder and director of iMetafilm said: “With everyone craving more and more digital content for use across countless media platforms, as well as a desire to protect and save film archives for future generations, iMetaFilm’s patented technology now unlocks and commercialises these archives for a wide range of existing and new markets of, literally, millions of hours of film of enormous commercial and cultural value.”

David Knox, managing director of iMetaFilm added: “People across the world have an endless interest in their past and the richness of content available through digitising film adds a fantastic dimension to the experience. The combined expertise of iMetaFilm and UK Archiving is very exciting for the digital archiving industry.”

The Kelvin Capital syndicate is led by directors John McNicol and Angus Hay and represents private investors in the UK, Europe and the USA. iMetaFilm is an existing Kelvin Capital portfolio company.

Issued on behalf of Kelvin Capital by Wave PR Ltd. For further information please contact Jonathan Kennedy on 0141-225-0400 or at jonathan@wavepr.co.uk

Notes to editors

Kelvin Capital Ltd. (Lead Investor) is a Scottish based, private investment fund, with over 220 angel investors and a diverse portfolio of 23 investee companies having made investments of over £30 million to date.

The Scottish Investment Bank (SIB) is the investment arm of Scotland’s national economic development agency, Scottish Enterprise, operating Scotland-wide in partnership with Highlands and Islands Enterprise (HIE). SIB’s activities support Scotland’s SME funding market to ensure businesses with growth and export potential have adequate access to growth capital and loan funding.

SIB manages a suite of co-investment funds including the Scottish Co-investment Fund, the Scottish Venture Fund and the Energy Investment Fund on behalf of the Scottish Government. SIB is also an investor in Epidarex Capital’s Life Sciences Fund and is a participant in the Scottish-European Growth Co-Investment Programme with funding secured from the Scottish Government’s Scottish Growth Scheme alongside the European Investment Fund.

SIB also provides funding into LendingCrowd, Scotland’s marketplace lender providing loans to SMEs, and Maven's UK Regional Buy Out Fund (MBO) that offers financial support for management buyouts (MBOs) and helps existing management teams acquire their businesses from their owners so they can continue to flourish. SIB’s team of financial readiness specialists help companies to prepare for new investment and access appropriate finance.

Contact Information

Press Office

Notes to editors

Notes to editors

Kelvin Capital Ltd. (Lead Investor) is a Scottish based, private investment fund, with over 220 angel investors and a diverse portfolio of 23 investee companies having made investments of over £30 million to date.

The Scottish Investment Bank (SIB) is the investment arm of Scotland’s national economic development agency, Scottish Enterprise, operating Scotland-wide in partnership with Highlands and Islands Enterprise (HIE). SIB’s activities support Scotland’s SME funding market to ensure businesses with growth and export potential have adequate access to growth capital and loan funding.

SIB manages a suite of co-investment funds including the Scottish Co-investment Fund, the Scottish Venture Fund and the Energy Investment Fund on behalf of the Scottish Government. SIB is also an investor in Epidarex Capital’s Life Sciences Fund and is a participant in the Scottish-European Growth Co-Investment Programme with funding secured from the Scottish Government’s Scottish Growth Scheme alongside the European Investment Fund.

SIB also provides funding into LendingCrowd, Scotland’s marketplace lender providing loans to SMEs, and Maven's UK Regional Buy Out Fund (MBO) that offers financial support for management buyouts (MBOs) and helps existing management teams acquire their businesses from their owners so they can continue to flourish. SIB’s team of financial readiness specialists help companies to prepare for new investment and access appropriate finance.